What are consumers’ top concerns when they pay their bills online? What are their preferences when it comes to managing their subscription services? For cash-strapped adults, would low-interest microloans serve as lifelines to help make ends meet in-between paydays?

These are just some of the questions BillGO wanted to explore in its latest survey of consumer bill pay preferences and priorities. Completed this summer in collaboration with PYMNTS, the survey, offers an insightful snapshot of what Americans need and want in bill pay and subscription management technology.

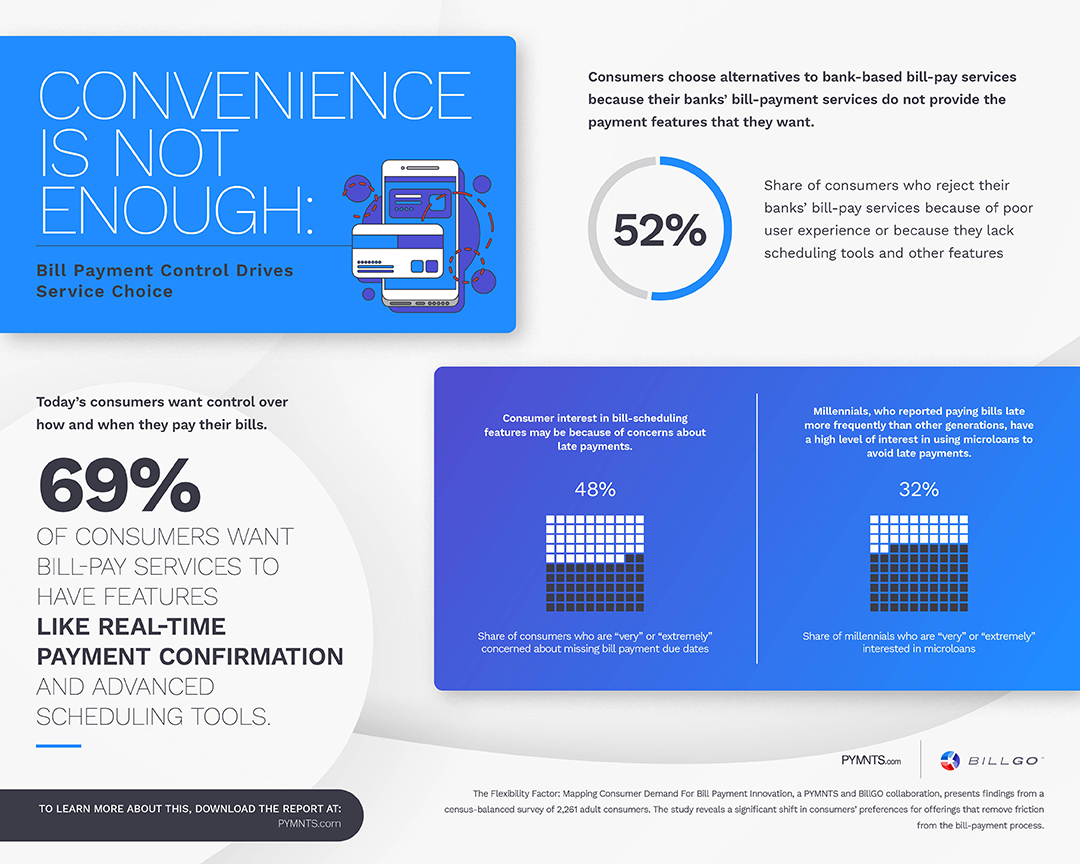

The final study, The Flexibility Factor: Mapping Consumer Demand for Bill Payment Innovation — drawn from a census-balanced survey of 2,261 adults — provides industry executives with an up-to-the minute look at what today’s consumer want when managing bills, subscriptions and payments.

As the infographic confirms, convenience is just the beginning. Nearly 7-out-of-10 consumers want bill bill pay scheduling features. Three-out-of-10 want real-time bill payment confirmations. Meanwhile, more than half of Americans reject the bill pay technology their financial institutions (FIs) offer.

But the infographic reveals only a small portion of the study's findings. The Flexibility Factor also examines:

- The growing popularity of using personal finance apps to manage bills

- The “Most Wanted” bill pay features broken down by user lifestyle

- How current economic uncertainty is shaping consumer bill pay concerns

- The growth of subscription services and a corresponding anxiety over data breaches

- Which factors would inspire consumers to take out microloans to help manage bills

Next Steps:

The newly-released, 10-page report is an invaluable resource for FI and fintech executives seeking insights into what their customers want when digitally managing bills and subscriptions.

Download your complimentary copy of The Flexibility Factor now!